July permit report were issued and once again they keep on building. Will they build until they GO BUST?

436 new permits for July 2006. Lennar pulled 102 and Pulte pulled 98.

Thursday, August 31, 2006

All this and they keep building

Posted by

Bakersfield Bubble

at

7:33 PM

8

comments

![]()

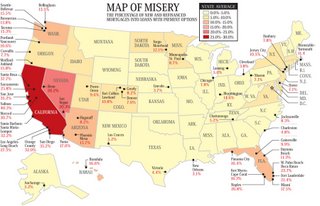

Business Week Expose on Mortgages

Businessweek has an expose on the Toxic Mortgages out there.

http://tinyurl.com/po4qc

Here is a great graph from the report:

Posted by

Bakersfield Bubble

at

3:53 PM

7

comments

![]()

Tuesday, August 29, 2006

NAHB trying to strong-arm the FED???

With housing slumping dramatically, hopes for a soft landing in the sector could be evaporating. According to Goldman Sachs (GS ), housing inventories are at their highest levels in more than a decade. Just how worried are homebuilders? A few weeks ago, on the eve of the Federal Reserve Board's Aug. 8 Open Market Committee meeting, the National Association of Homebuilders sent letters to Fed Chief Ben Bernanke and each of the other members of the interest-rate-setting committee. The message: Official stats don't capture how badly housing is hurting, since those figures don't include canceled contracts, which doubled over the past year. The letter also argued that inflation is more benign than feared, because one measure, rising rents, is overweighted in the consumer price index. NAHB Chief Economist David Seiders says this is the first time since he joined the staff, in 1984, that the group has written such a letter to the Fed.Granted, such a move seems mild compared with the actions of the early 1980s, when, to protest double-digit interest rates, a desperate NAHB mailed lumber (two-by-fours, meant to symbolize unbuilt homes) to then Fed Chief Paul Volcker. And it's not known if the NAHB's recent letter influenced the bankers in the marble temple, who chose -- for the first time in two years -- not to raise rates at its August meeting. But, says Tom Schlesinger, director of the Financial Markets Center, a Fed watchdog group, the urgent communication is "certainly a symptom" of the current anxiety.By Catherine Yang

Posted by

Bakersfield Bubble

at

6:09 PM

8

comments

![]()

Sunday, August 27, 2006

Why give away $75k of Equity?

Why give away $75k of Equity? BECAUSE there is no equity! This realtor posted this home on the craigslist - http://bakersfield.craigslist.org/rfs/198756634.html - stating that you would receive $75k of instant equity. Huh? They purchased the property on 2/13/06 for$425,000 and they are trying to sell for $475k minus the 4% commission they are willing to give to a realtor who can find another person take their position and the 6 months of carrying costs - they will be lucky to walk away with a small profit. This is only the beginning of the downturn, if they wait too long, they will go negative.

75,000. INSTANT EQUITY

4% to Selling Agent!!!

12206 Trackside Dr 93312

click picture for more information

Posted by

Bakersfield Bubble

at

2:14 PM

2

comments

![]()

WHAT IS THE REAL MONTHLY PAYMENT?

Reading today's local paper I came across several interesting items, I will focus on one of them. What is the real monthly payment? The ads posted above are for a new development in town. The article states "your payment can be as low as $741.03 per month". Does anyone believe this? Are there still a few souls out there who have not received the memo that this boom is going BUST!

Lets look at what the REAL monthly payment will be once you move in and the honeymoon period is over. What have they left out -

- They have assumed a 10% down payment and made no adjustment for the PMI due for not putting 20% down. This will add approximately $100 to the monthly payment.

- This loan has a teaser rate of 1% (APR listed is 6.609%), I will assume this 1% is only good for a year (as most are). Once this loan adjusts, $753 will be added to the monthly payment

- They also don't include the cost of property taxes and homeowners insurance. This will add $341 to the monthly payment

Using the above adjutments what is the real monthly payment - $1,935

I wonder how long these homeowners, errr debt slaves can last with this type of payment adjustment? Also, what would be the cost to rent? I assume much lower than this!

Posted by

Bakersfield Bubble

at

10:00 AM

5

comments

![]()

Friday, August 25, 2006

LOCAL STORY FROM KGET

Local real estate market shows signs of slowing Video

Posted 8/24/06BAKERSFIELD - The foreshadowed bubble burst of the real estate market could soon be a reality with home sales dipping to their lowest level in 2 1/2 years nationwide.

Sale prices are dropping across the country showing a sign of a slumping economy. The western part of the country has been hit the hardest, but Kern County appears to be in better shape.

So, if you've been trying to sell your home in the last few months, there is definitely a new trend. There are now more homes on the market with fewer buyers, pushing sales prices lower than last years. In fact, some say it’s a dramatic change from the boom days of 2005.

“The days of just putting a sign on the lawn and selling a house and getting four offers in two days for $10,000 over asking price are gone,” said local seller, Don Weagle.

Realtor with Prudential of Bakersfield, Diane White, said, “Sellers have in their head last year’s prices, and sellers really have to get last year out.” She adds, “They really have to sell their home, today”

Experts say in today’s market, sprucing up a for-sale home is a must, possibly even paying for things like closing costs.

Despite a nearly 6 ½ percent drop in west coast home sales, developers locally are optimistic.

“We're still living in a very good market,” said Miguel Soltero. “In some areas, Bakersfield being one of them, but I think we just got a little spoiled.”

Meanwhile, there is more than 4 times the number of homes for sale this year, than last year. And, everyone seems to agree that it has turned into a buyers market which is great for those looking to pick up a new home.

But, with both buyers and sellers waiting for better days, there's fear the economy could go the way of a slowing housing market.

Posted by

Bakersfield Bubble

at

9:25 PM

5

comments

![]()

IS OUR MARKET DIFFERENT??

Current inventory per the Bakersfield MLS is 4,122. A year ago the inventory was 942. Sales are down 35% YOY. If you ask a local realtor or other real estate expert all you will hear is "soft landing", "back to a more normal market", "we are the most affordable place to live in Ca", and on and on.

For these sales people its also always a great time to buy - "interest rates are going up, you better buy before they do", "interest rates are down, its a great time to buy". Is there ever not a great time to buy? Listen to the local show on 1410 on Saturday at 10:00 am and by 10:07 they have said at least 5 times that its a great time to buy.

What these local sales people, er... Members of the REIC (Real estate Industrial Complex - real estate agents, brokers, contractors, etc..) fail to recognize is the economic fundamentals of this town don't bode well for the future of housing prices in our town. The most obvious to me are: 1) Real wages are flat since 1998 2)Median home prices are up 150% since 1998 3) Median wages times home prices is now at 7.5, this number was at 2.7 in 1998. Wages have not kept up with the cost of housing. The only real job creation in this town is warehouse work and REIC jobs. The REIC jobs will vanish in the next 6-12 months. NO OUR MARKET IS NOT DIFFERENT! In fact I would say that markets like ours, that had the most significant appreciation, will see the most significant depreciation! With this blog I will attempt to expose the lies and truth about the Bakersfield market!

Posted by

Bakersfield Bubble

at

8:33 PM

1 comments

![]()

Thursday, August 24, 2006

Sales of new homes down 21.6% in past year

WASHINGTON (MarketWatch) -- Sales of new homes dropped 4.3% in July to a seasonally adjusted annual rate of 1.07 million, the Commerce Department said Thursday. New-home sales are down 21.6% in the past year, the biggest drop since late 1994.

Inventories of unsold homes rose to an 11-year high, while median prices flattened out.

The report confirms a dramatic decline in real estate in July. Existing home sales fell 4.3% in July, the realtors reported Wednesday. Total home sales fell to 7.4 million annualized in July, the lowest since January 2004. Total sales are off 12.9% in the past year.

The Federal Reserve will be keeping a close eye on the impact of the housing bust on the rest of the economy as it tries to steer the economy between recession and inflation.

Economists just can't agree on how much pain will be felt. "This is the wild card in the economic outlook," said Ken Mayland, chief economist for ClearView Economics.

"Is the economy sailing into just headwinds or a hurricane?" wondered Peter Morici, a business professor at the University of Maryland. "The economy is likely slowing more than the Federal Reserve anticipated"

"Current trends in the U.S. housing market are consistent with just a modest slowing of the economic activity," said Lewis Alexander, chief economist for Citigroup Global Markets in his global update to clients. "That said, the pace of the downdraft in the U.S. housing market bears watching. It may be a leading indicator of a more significant correction in that sector and the U.S. economy overall."

The July sales pace was the lowest since February's 1.038 million. July's sales were weaker than the 1.10 million expected by economists surveyed by MarketWatch. There were also significant downward revisions for April, May and June data. See Economic Calendar.

Inventories of unsold homes rose 1.1% to a record 568,000 in July, representing a 6.5-month supply at the July sales rate. That's the largest months' supply since November 1995.

Inventories are up 22.4% in the past year.

Builders have said they are cutting prices and offering incentives to boost sales to keep inventories from building up.

The median sales price in July was up 0.3% year-over-year to $230,000. Because of sales incentives, the reported median sales prices overstate prices, Mayland said.

On Wednesday, the National Association of Realtors said sales of existing homes fell about 4.1% to a seasonally adjusted annual rate of 6.33 million, while inventories rose to 13-year high and year-over-year price appreciation was flat. Prices were up just 0.9% in the past year. See full story.

Builders' sentiment has collapsed in the past year, housing starts are down, and major builders have reduced their forecasts for construction for this year and next.

The government cautions that its housing data are subject to large sampling and other statistical errors. Large revisions are common.

The standard error is so high, in fact, that the government cannot be sure new-homes sales decreased at all in June. The 4.3% decline in July is statistically meaningless.

It can take up to six months for a trend in sales to emerge. New-home sales have averaged 1.10 million per month over the past six months, down from 1.12 million in the six-month period ending in June. The six-month sales average has fallen eight months in a row; it was 1.29 million in December.

Regionally in July, sales fell 21.3% in the Midwest and fell 8% in the South. Sales rose 11.7% in the West and 1.8% in the Northeast. In the past year, sales are down 42.9% in the Northeast, 35.4% in the Midwest, 23.4% in the West and 12.4% in the South.

Sales in the Midwest fell to the lowest pace in nine years in July.

Inventories in the Midwest are down 1% in the past year, but are up 30% in the West, 28% in the South and 33% in the Northeast. Rex Nutting is Washington bureau chief of MarketWatch.

Posted by

Bakersfield Bubble

at

9:47 AM

11

comments

![]()

Wednesday, August 23, 2006

FLIP or FLOP??

Will this Flipper make it? Or is he too late in the game to turn a profit? Purchased 3/31/06 for $1,750,000 add in the carrying costs to date (estimated) and he is at $1,800,000. Orginally on the market for $2,600,000 now for sale at $2,200,000. Will some greater fool come along??

http://tinyurl.com/pvdld

Posted by

Bakersfield Bubble

at

8:25 PM

7

comments

![]()

Recession

AutoNation chief warns of recession

Largest auto chain in U.S. sees O.C. as leader in long-term growth of luxury-car segment.

By JOHN GITTELSOHN

The Orange County Register

The chief executive of the nation's largest auto-dealing company said Tuesday the economy is "at a tipping point," threatened with recession as rising interest rates undermine consumer confidence.

"The question is how bad a recession," said Mike Jackson, CEO of AutoNation, which owns 338 auto franchises, including House of Imports in Buena Park, Power Toyota Cerritos, Lexus Cerritos and Power Toyota Irvine.

During the first six months of this year, auto sales fell 0.3 percent nationwide and 6.8 percent in Orange County. Sales of autos and gasoline account for almost one-third of retail spending in Orange County, according to the Center for Economic Research at Chapman University.

Esmael Adibi, the center's director, said it's premature to call it a recession but agreed that rising interest rates are undermining spending. "You can clearly see a slowdown, but it's still growing," he said.

Fort Lauderdale-based AutoNation accounts for about 3.5 percent of vehicle sales nationwide, with 2005 revenue of $19.25 billion.

Jackson, who gave an interview to The Orange County Register before addressing 2,500 AutoNation employees at the Orange County Performing Arts Center, said interest rates, not rising fuel prices, are the biggest damper on purchasing decisions.

Orange County's auto market is, in some ways, a leader of national trends, especially among premium luxury brands, such as Mercedes, Lexus and BMW, which ranked fifth, seventh and eighth respectively among the most popular brands in Orange County.

"Luxury has increased from 11 percent to 22 percent of revenue for us today," he said. "Our feeling is premium luxury is going to grow faster in the next 10 years."

Posted by

Bakersfield Bubble

at

8:16 PM

0

comments

![]()